Since 2020, the Magnolia ISD tax rate has decreased more than 32 cents. If you look historically all the way back to the 2015-16 school year, the total local school tax rate has decreased more than 42 cents.

Since 2020, the Magnolia ISD tax rate has decreased more than 32 cents. If you look historically all the way back to the 2015-16 school year, the total local school tax rate has decreased more than 42 cents.

Two Budget Buckets

School district tax rates are made up of two parts: Maintenance & Operations or M&O and Interest & Sinking or I&S. The M&O tax rate is added to the I&S tax rate to create a district’s overall school tax rate. The total school taxes due equals the total school tax rate multiplied by the assessed value of the property then divided by 100.

M&O tax collections help pay for expenses like salaries, supplies, utilities and other daily operating costs. I&S tax collections may only be used to pay down debt for school improvements, construction and interest incurred when voters approve a school bond election.

I&S tax collections cannot be used to pay for daily expenses like salaries and benefits.

Due to changes in school finance and tax compression laws, the M&O rate fell from $0.6712 per $100 assessed valuation in 2023-24 to $0.6669 per $100 assessed valuation in 2024-25. The I&S rate remained flat at $0.2926, resulting in an overall tax rate of $0.9595.

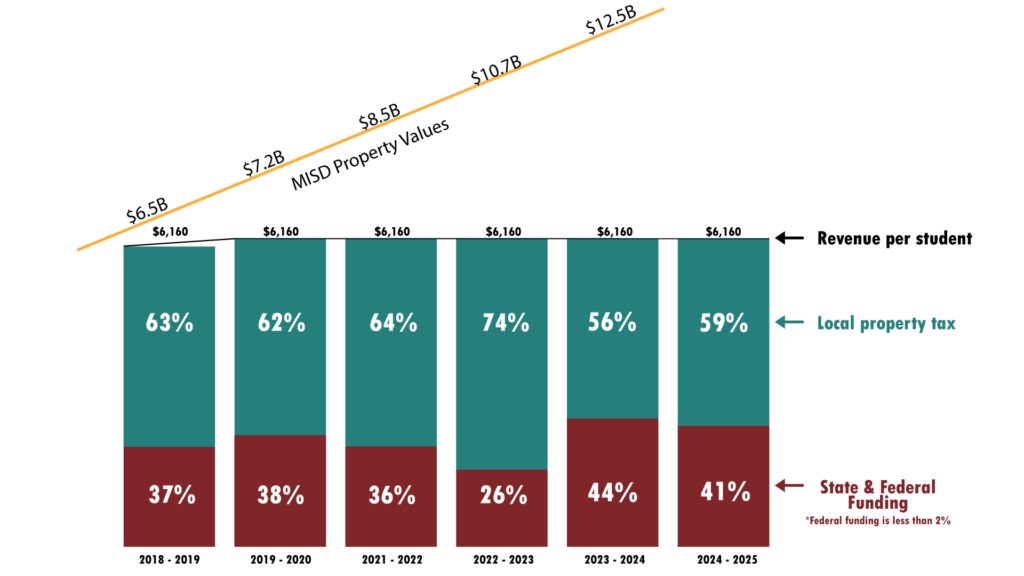

Rising Property Values Do Not Mean More Money For Schools

Many taxpayers do not realize that increases in the taxable values of commercial and residential property within the district do not benefit Magnolia ISD. Based on the current school funding laws in Texas, when taxable values increase, state funding decreases.

One option districts do have available to help maximize state funding is a Voter-Approval Tax Ratification Election or VATRE. A VATRE, or School Referendum, is a local school funding election that asks voters to authorize additional pennies on the school tax rate to address budget shortfalls or special initiatives like school safety or teacher salaries.

In November 2024, Magnolia ISD used the only mechanism the state gives school districts to receive more money for operating costs: asking the voters to increase the tax rate in a Voter Approval Tax Ratification Election (VATRE). Voters rejected the VATRE by 60%, despite the district maintaining balanced budgets since 2008 and being fiscally responsible.